Your love of orchestral music can be your legacy.

The HPO connects and strengthens our region through exceptional orchestral music experiences.

Over the last 140+ years we have been the region’s professional orchestra, consistently staging high quality, inspirational and inclusive live performances that bring audiences together for the shared experience of being moved, challenged and transformed by the power of orchestral music.

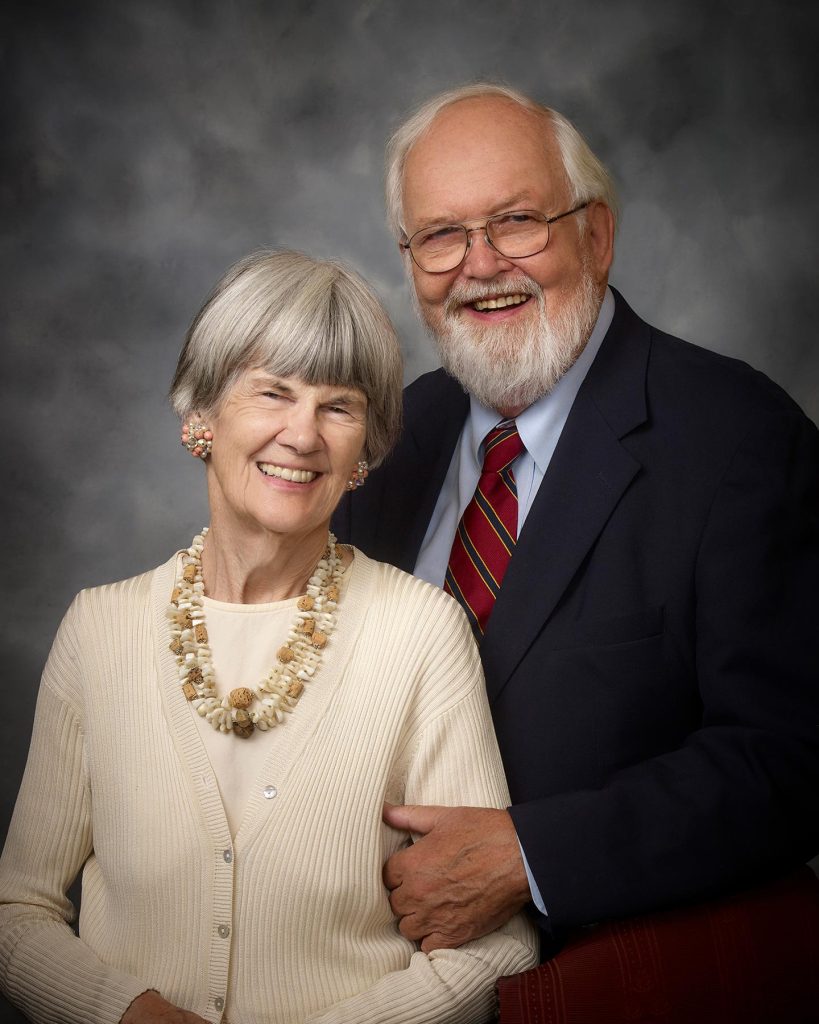

The Turkstra Legacy Circle

In honour of Carl and Kate Turkstra, who together shared a passion for the arts and a fervent belief in the power of the arts to enrich communities, we have created the Turkstra Legacy Circle.

The Turkstra Legacy Circle recognizes those who leave a legacy in their Will to the HPO.

Your love of orchestral music can be your legacy.

Preserving and building upon the accomplishments of the HPO is the mission of the Turkstra Legacy Circle, whose members make provisions for the HPO in their estate plans.

Help sustain orchestral music in this region for generations through a legacy gift. Your gift will:

- Support artistic excellence and innovation in all aspects of our programming, education and outreach.

- Support wellbeing through music with programming that is accessible and inclusive.

- Support inspiring music education and community engagement programs.

By informing the HPO of your legacy plans you become a member of the Turkstra Legacy Circle and:

- Encourage others to leave a legacy.

- Allow us to honour you during your lifetime.

- Make it possible for the HPO to plan for its future.

Benefits of membership in the Turkstra Legacy Circle include public recognition (if desired) and invitations to an annual exclusive Turkstra Legacy Circle event. Create your own legacy dedicated to the future of great music by making a future commitment to the HPO and ensure that exceptional orchestral music will benefit others for years to come!

YOUR LEGACY AND THE FUTURE OF THE HPO

The Hamilton Philharmonic Orchestra has created a legacy of music in our region that has continued to transform the lives of people of all ages for 140 years.

Leaving a legacy gift is one of the best ways you can help ensure that the Hamilton Philharmonic Orchestra continues to inspire audiences and musicians alike. Your support today plays a crucial role in sustaining the HPO’s artistic excellence, commitment to education and community engagement. A well planned gift also provides you with tax advantages while looking after your family and loved ones. Your financial advisor can help you choose the best vehicle that will enable you to achieve your goals. We are also here to help. Please do not hesitate to contact us. Any discussions will be kept in the strictest confidence.

WHAT IS A LEGACY GIFT?

A legacy gift, also known as a planned gift, is given through a bequest in your will, a life insurance policy, annuity, securities, and other financial instruments.

WHAT ARE THE BENEFITS OF MAKING A LEGACY GIFT?

Legacy giving benefits both the HPO and you. The funds create a legacy supporting the mission of the HPO into the future, while you or your estate receive attractive tax benefits.

- You make a significant contribution to the cause that is most important to you during your lifetime and beyond.

- The charitable tax credit can be maximized to reduce final income taxes.

- When you donate shares of Canadian cultural property, listed appreciated securities, or when you receive an annuity you may receive additional tax benefits during your lifetime.

HOW DO I MAKE A LEGACY GIFT?

After taking care of your loved ones, leaving a gift of any size to the HPO is an easy and practical way of creating legacy when you are establishing or updating your will.

Types of charitable bequests you might want to consider are:

- A Specific Bequest: A dollar amount or percentage of the value of your estate assets.

- A Residual Bequest: All or a percentage of the residual portion of assets to be donated after all other specific wishes, taxes, etc.

- A Contingency Bequest: Provides a legacy gift to be made should one or more of your named beneficiaries not survive you.

- A Codicil to Your Will: An addition to your will explains your wish to make a gift to the Hamilton Philharmonic Orchestra

Life Insurance

A gift of life insurance can be an impactful way to support the HPO and benefit you with tax relief immediately or it can be deferred to your estate. The insured amount of a life insurance policy is considered separate from your estate. Working with your trusted advisor, you can name the Hamilton Philharmonic Orchestra as the owner and beneficiary of a new or existing policy. You will be receive tax receipts for each premium payment you make or the tax benefits can be deferred to your estate.

Other Ways to Give

You can also name of the Hamilton Philharmonic Orchestra as a direct beneficiary of your RRSPs, RRIFs, TFSA or corporate pension plan. Your estate will receive tax relief and your gift will not have to pass through probate. Speak with your trusted advisor to review what’s required to change your beneficiary.

WHAT IS THE TAX ADVANTAGE?

Legacy gifts enable you to ensure that your assets are distributed according to your wishes and that the taxes payable on your death are reduced or sometimes even eliminated. Speak with your family and trusted advisor to determine how this might work for you.

THE TURKSTRA LEGACY GIVING CIRCLE

If you have made a gift through your will, life insurance, registered plans or (RRSP/RRIF/TFSA), or any other type of legacy gift, we invite you to join the Turkstra Legacy Circle. Named in honour of Carl and Kate Turkstra, who together shared a passion for the arts and a fervent belief in the power of the arts to enrich communities, the Turkstra Legacy Circle recognizes and celebrates your gift today through:

- Recognition in concert programs and on the HPO website

- Invitations to an HPO Open Rehearsal

- Access to the Conductor Circle Lounge during intermission at every HPO concert

- Invitations to an exclusive annual Turkstra Legacy event

- Continuing recognition of your estate in concert programs and on the HPO website.

After including the HPO in your estate plan, be sure to inform us so we can welcome you to the Turkstra Legacy Circle. And, of course, we respect all requests for anonymity.

RECOGNIZING YOUR GIFT

The Hamilton Philharmonic Orchestra welcomes the opportunity to discuss your needs and to recognize your bequest or other forms of planned gifts in a meaningful way. Depending in the size of your gift, your name or the name of a loved one can be associated with a number of significant programs, facilities or activities at the Hamilton Philharmonic Orchestra, e.g., naming the Chair of your favourite instrument.

WHAT ARE THE NEXT STEPS?

We can help you plan your gift, working with you, your family and your advisors to ensure that your financial and philanthropic goals are met. The next time you review your estate plans, please consider including the Hamilton Philharmonic Orchestra.

Click the triangle to the left to see a sample bequest letter

WE RESPECT YOUR PRIVACY

We recognize that your Will and estate plans are very personal to you. Any information that you choose to share with us regarding your legacy commitment will be kept in the strictest confidence.

CONTACT US

Kim Varian, Executive Director

289.216.8413

kvarian@hpo.org

THANK YOU FOR SUPPORTING THE HAMILTON PHILHARMONIC ORCHESTRA

Please note that the information on this page does not constitute legal or professional advice and should not be substituted for appropriate professional advice. The Hamilton Philharmonic Orchestra strongly recommends that you seek professional legal and financial advice to ensure your financial situation and those of your dependents are considered; that your tax situation is reviewed; and that your legacy gift is tailored to your circumstances.

HPO is a member of the Will Power legacy giving education program.